Today, the world continues to experience new developments and advancements that foster developments in the form of connectivity, communication, and transport. As a result, investment opportunities are created in various regions and countries across the globe. Global development and interconnectivity increase the ability of various businesses and enterprises to penetrate diverse markets and explore new business possibilities beyond national borders. However, to make such endeavors successful, entrepreneurs and investors must understand the concept of global diversity and how it affects market dynamics.

To effectively comprehend global diversity, investors must become familiar with all its aspects; social, economic, and cultural aspects. All aspects of global diversity directly impact business practices, consumer behavior, and the emergence of potential investment opportunities in different ways. This article will discuss how the comprehension of global diversity and the adoption of cultural awareness can inform and improve investment decisions, resulting in enhanced consumer engagement, improved brand loyalty, and higher profit margins.

The Importance of Global Diversity to Foreign Investors

1. Market Insights and Consumer Behavior

All markets’ consumer preferences, spending patterns, and general purchasing behavior are highly influenced by diverse factors. Target populations often make purchasing decisions that are perceived as part of the norm or routine in their community. For example, in China, purchasing collectibles outside one’s basic needs is considered part of societal norms. However, in countries such as the USA, purchases are more influenced by one’s autonomy or personal choice and preferences. Such tendencies are influenced by groups and societal expectations.

Researchers have found that deeper comprehension of a target market’s cultural beliefs and practices may result in better product-market fit. As a result, the product or service will achieve better success rates when penetrating foreign markets. Organizations or enterprises that take their time to study the target population’s demographic characteristics (including gender, age, socioeconomic status, and religion) will gain a better understanding of the specific needs of the community. This approach effectively helps investors prevent avoidable missteps and ensures that the product or service offered is relevant to the target population’s needs, eventually boosting consumer engagement and sales.

2. Fostering Brand Loyalty and Trust

Trust is a crucial element in business and investment, especially in regions that are susceptible to economic instability. Cultural awareness ensures that investors create a strong relationship with target markets in foreign countries. Eventually, such relationships create a sense of trust and loyalty between the brand and the market.

Building a relationship based on trust requires that the enterprise or corporation establishes its presence, communicates using local dialects or languages, acknowledges and respects local beliefs, and contributes positively to the community’s advancement. Investors or businesses that prioritize comprehending the local beliefs and practices of a target population are more likely to create a long-term relationship which is an important component for growth and stability in international markets.

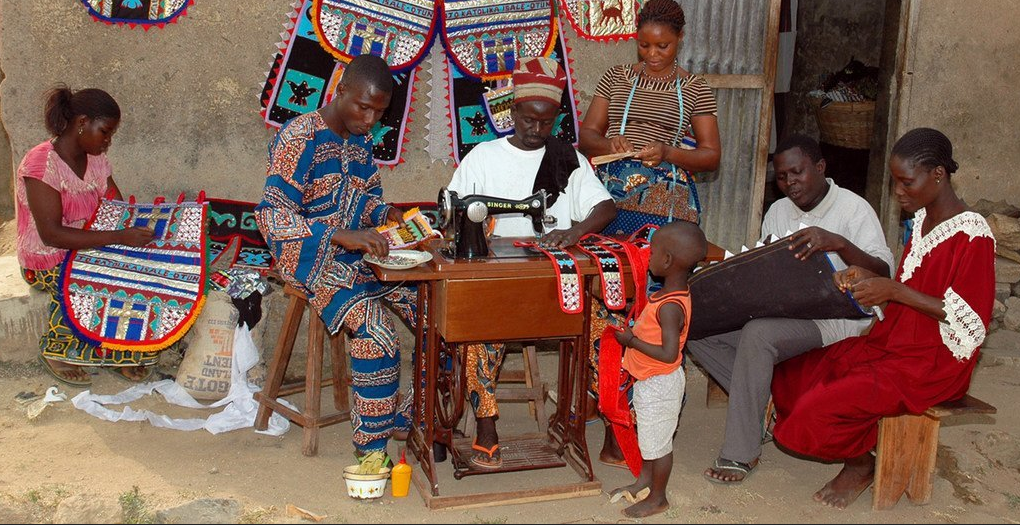

A practical example of brand loyalty is the relationship that exists between Unilever and African countries. When Unilever penetrated the African market, the multinational corporation prioritized community engagement which was useful in understanding the African market. Eventually, the corporation produced goods that met the needs of the general African market, creating a strong relationship built on trust.

3. Corporate Social Responsibility (CSR) and Sustainability

Today, many foreign investors comprehend the importance of corporate social responsibility (CSR) and sustainability when penetrating new markets. However, it is important to note that the concept of CSR varies across various communities and cultures. For instance, in African countries, community-based initiatives are more likely to foster support and trust among various communities unlike in Western countries where environmental sustainability is considered more important.

It is the responsibility of investors to identify these variations and preferences across different markets and develop CSR initiatives that are relevant to local community needs. Such approaches to foreign markets ensure that the brand goals are in line with consumer expectations. An example of a corporation that has mastered this approach is Nestlé. The brand penetrated the African market intending to address regional challenges such as malnutrition and food shortage. This approach boosted Nestlé’s reputation because the corporation is committed to fostering development and improving the well-being of the local community.

4. Improving Employee Relations and Diversity

Diversity is not only relevant to strategies and approaches applied in consumer markets but is also relevant to the workforce. Research indicates that diverse teams are likely to be more productive, innovative, and resilient. Diverse organizations create an environment that welcomes different perspectives which positively contribute towards creating innovative solutions to existing challenges and eventually improving the organization’s competitiveness.

A study conducted by Harvard Business Review concluded that organizations with diverse workforces are 70% more likely to excel in foreign markets compared to less diverse organizations. Therefore, investors who are open to diversity are better positioned to foster innovation in a wider pool of talented individuals from different backgrounds. Diversity ensures that any organization is adaptable to shifts in the market and addresses challenges more effectively, especially in the global market.

Potential Challenges in Embracing Global Diversity

While embracing global diversity has numerous advantages for foreign investors, various challenges may arise when penetrating global markets. When left unaddressed, these challenges may eventually hinder market penetration and profitability. These challenges include

1. Global Diversity Complexity

Global diversity is multi-dimensional and complex. In some cases, the specific needs of a foreign market may be misunderstood, resulting in the development of ineffective market penetration strategies that may alienate the target market. The process of studying and comprehending specific subcultures, especially in diverse regions, may be resource-intensive and time-consuming. Therefore, foreign investors must ensure that they allocate sufficient resources and time to conduct effective market research to successfully penetrate foreign markets.

2. Language Barriers

When entering foreign markets, investors often experience language or dialect barriers. If left unaddressed, such issues may result in miscommunication and strained relationships between the investors and key stakeholders. A lot of resources must be invested in translation services to ensure that all relevant documents accurately represent the intention of the investor. However, small-scale investors may not afford to invest in these resources because of how costly they are.

3. Legal Requirements and Regulatory Standards

Every country has unique regulatory and legal frameworks, which often represent its values and societal priorities. Some countries have more stringent requirements in place compared to others. However, it is the responsibility of potential investors to familiarize themselves with these requirements and adhere to them. Navigating and fully adhering to some of these requirements require in-depth legal and cultural knowledge of the country. However, in some cases, compliance may prove difficult resulting in operational restrictions and fines.

4. High Operational Costs

In some cases, adopting strategies based on global diversity may increase operational costs. Penetrating foreign markets requires the conduction of comprehensive market research, hiring local experts, and the adoption of campaigns to suit local practices and beliefs, which can be very expensive. Such costs may be met easily by bigger corporations but smaller investment companies may have a difficult time penetrating foreign markets because of financial constraints. However, it is crucial that when making financial decisions, a good balance between operational costs and cultural adaptations is achieved to ensure successful market penetration.

Global diversity continues to influence foreign investment landscapes across the globe. To achieve long-term success in foreign markets in the modern market, investors must understand and respect global diversity by establishing strong relationships with consumers, creating innovative and applicable business models, and tailoring their goals to the needs and values of local communities. This way, they will ensure that their investments are not only profitable but also socially responsible and culturally respectful. Challenges may arise when exploring foreign markets however, it is the responsibility of the investor to address them proactively to foster competitiveness in the foreign market. Eventually, investors who foster global diversity create more effective and resilient investment strategies.

References

Harvard Business Review. (2021). How Cultural Differences Impact International Business in 2021. Retrieved from https://hbr.org/2021/01/how-cultural-differences-impact-international-business-in-2021

McKinsey & Company. (2020). How to win in emerging markets: Lessons from 20 years. Retrieved from https://www.mckinsey.com/industries/public-and-social-sector/our-insights/how-to-win-in-emerging-markets-lessons-from-20-years

World Bank. (2022). Doing Business 2022: Understanding Regulations for Small and Medium-Size Enterprises. Retrieved from https://www.worldbank.org/en/publication/doing-business-2022

McKinsey & Company. (2022). The power of diversity in driving innovation and business growth. Retrieved from https://www.mckinsey.com/business-functions/organization/our-insights/the-power-of-diversity-in-driving-innovation-and-business-growth

Harvard Business Review. (2018). The Impact of Culture on Innovation and Strategy: Key Insights for Businesses. Retrieved from https://hbr.org/2018/06/the-impact-of-culture-on-innovation-and-strategy-key-insights-for-businesses

World Bank. (2021). Data Privacy and Regulatory Challenges in the Digital Age. Retrieved from https://www.worldbank.org/en/news/feature/2021/01/01/data-privacy-and-regulatory-challenges-in-the-digital-age